Highlights:

- Redcastle, located in Victoria, Australia is one of the most significant historic epizonal goldfields in the state, with high-grades and common visible gold in a quartz (+/- stibnite association);

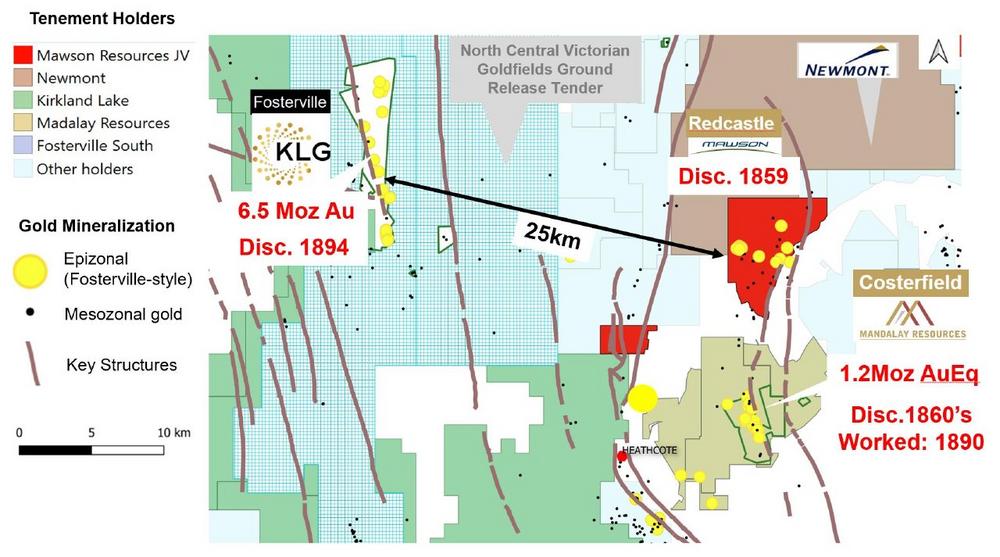

- The first mined of three historic central Victorian goldfields (ca. 1859). Mining at the nearby Costerfield and Fosterville began later in ca. 1860s and 1890s respectively (Figure 1);

- Extremely high gold grades were mined over a 4.5 x 7 square kilometre area containing over 24 historic mining areas that extend over a combined 17 kilometres of combined high-grade vein strike;

- Mawson to commence a detailed geophysics programme during July, followed by a diamond drilling campaign in at both the Sunday Creek and Redcastle projects in Victoria, commencing from mid-August.

Mr. Hudson, Chairman and CEO, states, “The extremely high grade, free and visible gold associated with quartz and stibnite at Redcastle developed over a significant area make it one of the key high grade epizonal gold fields in Victoria, along with the Swan Zone at Fosterville and the Costerfield Mine, which lies immediately along strike to the south. It remains astounding that the project remains untested below the water table (50 metres average depth). Mawson will commence geophysics at Redcastle during July, followed by a diamond drilling program in late August/early September.”

Redcastle History

Redcastle was discovered in 1859 at the Staffordshire Flat alluvial field. The first hardrock gold discovery was Clarke’s Mine in 1859 by a party of Italians and Austrians, led by Antonio Geronovitch, then named the Balmoral Diggings. ‘Redcastle’ a name of Scottish origin, displaced Balmoral (also of Scottish origin) in 1860. In Bailliere’s Victorian gazetteer (1865), it was reported that Redcastle had police and court facilities, a post office, two hotels and three quartz-crushing mills. Mining was most active between 1859 – 1865 and to a lesser extent from 1866-1896. The last hotel closed in 1913, the school closed in the 1930s, and by 1972 the district’s population was estimated to be three people.

Exploration and development of the Redcastle goldfield was earlier than that of Costerfield gold-antimony field to the south. Many of the Redcastle mines were already abandoned prior to the development of the Costerfield mineralization in the 1890’s. The Redcastle mines were documented to have closed in the 1800’s through a combination of factors, including inadequate pumping to dewater the mines below the water table and continual water shortage for crushing and treatment issues associated with iron oxide coating of gold in the oxide zone and stibnite in the hypogene zone. Faulting of mineralization, with difficulty extending workings across fault zones, and a lack of geological knowledge (only 3 mines in the field were investigated by geologists) also led to abandonment. The rush to pay dividends versus appropriate capitalization of the mines, and the high cost of mining in hard rock and the transportation costs to offsite batteries (only 3 mines had their own crushing plants), combined with a transient labour force and the rush to Bendigo in 1871 also led to further demise at the time.

Redcastle Economic Geology

During the 1800’s the average mining width was approximately one metre on quartz veins with visible gold (individual reef widths were less than 0.6 metres). The length of workings combined is 17 kilometres with several reef systems extending for kilometres. Spurs off the main reef systems were recorded to have been worked for distances between 15-33 metres. It is a characteristic of Redcastle that reefs are closely spaced, on the western side of the field 14 reefs are recorded to occur in a cross-strike distance of 900 metres.

At Redcastle, the key historic targets were narrow but continuous thin (0.3-1 metres) very high-grade structures continuing to depth. Historical records however, continually reference gold found marginal to reefs in the country rock (wall-rock of quartz-vein structures) with shallow modern-day reverse circulation drilling and trenching confirming that gold extends beyond these high-grade quartz-vein structures. Beyond the high-grade visible gold in quartz-veins, additional targets included vein stockworks in sandstones and dyke-hosted mineralization. The largest dyke was mined to a depth of 27 metres and was 11.5 metres wide at 25-120 g/t gold from 160 tonnes suggesting the dyke may have been selectively mined, although the width of the dyke suggests scope for a larger scale and lower grade target. Wider zones in stockworks (2.4-4.8 metres wide) and breccia zones at Beautiful Venus have been recorded up to 20 metres in width.

A selection of the more notable mining areas at Redcastle, none of which have been tested below old workings by drilling, include (Figure 2):

Welcome or Clarkes Reef: A reef system covering 800 metres in strike length, traced for 4.8 kilometres between workings along the same trend and reefs close spaced with 14 reefs recorded in a cross-strike distance over 900 metres. The final mining depth was 125 metres and reports state that 21.8 g/t gold was left at the base of the mine. The group produced 35,000oz of gold of which 28,850oz were produced from 8,669.5 tonnes at a grade of 103.6 g/t gold. The water table ranged between 42-76 metres depth which restricted deeper mining.

The McIvor Times reported that 60.9 tonnes of quartz for 969 oz at 446 g/t gold were mined within a year of its discovery in 1860. The Clarke mine went on to produce 20,583oz at 254.6 g/t gold in the following six years from 1859 to 1865. Sporadic mining continued until 1896. In 1885 Forbes and Murray reported the line of workings had exceeded 3 kilometres in length at surface and the mineralized zone as 1.2 metres wide with individual laminated veins from 5-7cm wide to 35cm wide. The quartz was described as “very-rich in gold – every piece knocked out from either side containing fine gold well disseminated not only in the seamy portions but in the solid stone itself”. Murray (1894) reported the main shaft had reached about 76 metres depth and the lode mined for nearly 800 metres in strike length, and ceased at the water-table level. Adjacent to the main shaft yields were stated as being up to 1,171 g/t gold. Forbes in 1898 reported the shaft had reached 110 metres and the reef had been stoped out from surface to 73 metres depth for 36.5 metres to the north and considerably further to the south and averaged 20 cm to 38 cm in width. In this zone a shoot of “golden stone” over 53 metres in length, 0.2-0.4 metres wide, averaged 167 g/t to 558 g/t gold and pitched 25 degrees to the north. The mine passed through 15 owners because of uncoordinated efforts between of the companies working the trend, unnecessary shaft duplication, plant and machinery and hungry shareholders.

Why-Not Reef: The McIvor Times reported in 1879 that the reef was 4.9 metres wide and the last crushing produced 128.3 oz at 21.6 g/t gold from 188 tonnes. In 1885 Forbes and Murray, although they did not visit the mine, stated that the mine is said to contain a formation of mullock and quartz veins (stockworked) 3.6 metres thick from which bulk crushings of about 279 g/t gold were obtained. The shaft reached 61 metres deep with reef width from 2.4 to 3.6 metres and yielded 85 ozs gold at 29.1 g/t gold from 90.7 tonnes.

Mitchel Reef: In 1893 the McIvor Times reported the Mitchel line of reef was in parts 1.2 to 2.4 metres thick and yielded from 5.6 g/t to 111.6 g/t gold. Thousands of tonnes of mullock was on surface and graded 8.5 g/t gold.

Beautiful Venice Reef: Murray (1894) stated that there are four reefs located about 2.5 kilometres east of the Welcome Group. The deepest shaft was 76 metres and good stone was left underfoot. Yields of up to 418 g/t gold are reported and thickness from the old stopes is from 0.6 metres to 0.9 metres. Another reef here known as Chapmans line was worked for 366 metres in length and down to 61 metres, auriferous the whole way and only abandoned because of water. Forbes (1898) reported workings over 61 metres at surface down to 30 metres at the bottom of the shaft, with the reef between 0.6-0.9 metres thick, antimony associated with it and yielded between 23 g/t and 42 g/t gold. Another reef about 55 metres west of Chapmans was worked for 21 metres in length and 46 metres in depth over 0.23 metres to 0.46 metres width and yielded from 223 g/t to 279 g/t gold.

Mary-Ann Reef: Hird 1976 reported that both his father and grandfather had worked their entire lives in the mines at Redcastle, Costerfield, Mount Wills and Bendigo. His father said that the Mary-Ann reef was in his opinion the best mine in Redcastle and the reef left in the bottom of the winze was good in both antimony and gold and a very good size lode.

Hit and Miss Reef: Hird 1976 reported it was worked to about 46 metres depth, the reef very broken but very rich. A new shaft sunk to 76 metres missed the ore but, it is believed that it was sunk too far to the south as the ore probably dipped to the north, as is common on the Redcastle line. Hird believed this reef “a good bet for anyone with a diamond drill”.

Burgess’ Mullocky Reef was opened in 1898 with a shaft to 18 metres depth. Lidgey (1898) described the reef to consist of folded and contorted beds of slate and fine-grained sandstone, traversed by innumerable small quartz veins. Forbes in 1898 described the reef to be a crushed sandstone with fine threads of quartz and bulging from 0.3-2.4 metres thick.

Chapman and Babbage: In 1893 the McIvor Times reported a new reef discovered about 1.6 kms north of Why-Not that produced 6.3 tonnes of ore from a 3 metre thick zone yielding 30 g/t gold. Forbes in 1898 described a shaft was sunk to 24 metres with only a 7.6cm wide reef and coarse gold evenly distributed. Two shoots were worked from surface to 12.1 metres deep, and a second from 15.2 to 18.3 metres.

Union Reef: Murray (1894) reported that this reef is located about 1.6 kms eastward from Clarkes and the shaft was 30 metres deep. Rich antimony shoots in pipes from surface were mined up to 3.6 metres long and 0.61 metres thick. The stibnite ore was very pure and contained considerable amounts of visible gold.

Modern Exploration

The first modern exploration at Redcastle took place in 1985. Previous workers have exclusively focused on heap leachable near-surface gold at Redcastle. No prior explorer has searched for high-grade gold beneath and along strike from existing mines. Apart from a ground magnetic survey in 1988 on a 400 by 40 metre grid, no systematic geophysical coverage of any type has been undertaken at Redcastle.

A total of 270 of reverse circulation (“RC”) and rotary airblast (“RAB”) drillholes have been drilled at Redcastle since 1985. The deepest hole is 81 metres and average drill hole depth is 38 metres. All drilling tested for low-grade oxide halos around old workings. None tested for high-grade extensions below the historical high-grade gold mines. Selected drill results at Redcastle included: 10 metres at 2.5 g/t gold from 22 metres (RRC26), 2 metres at 10.7 g/t gold from 39 metres (RRC41) and 2 metres at 6.3 g/t gold from 26 metres (PR16). None of the drill data have been independently verified at this time. The true thickness of the mineralized intervals is not known at this stage. Significant soil rock-chip sampling and costean sampling have taken place on the project.

All mining areas are within areas of outcrop however, approximately 50% of the tenement area lies underneath thin alluvial cover within extensive gullies (Figure 2).

Mawson’s Plans

Mawson plans a twofold approach at Redcastle. Initially the Company will systematically collect "tenement-scale" data to understand the broad mineral system and allow it to also explore beneath the significant alluvial cover. This includes ground magnetics, gravity and gradient array induced polarization ("IP") to test the entire Redcastle mineralizing system.

Secondly the company plans to start drilling from late August 2020, to test beneath the high-grade old mines by combining the "tenement scale" data with dipole-dipole IP and detailed analysis of historic mine records.

A geophysical contractor will mobilize to site over the next week, followed by a drill contractor from mid-August, 2020.

Victoria

Victoria hosts one of the giant orogenic goldfields in the world with more than 80 Moz extracted since 1851. The State is now experiencing its third gold boom with the discovery of the Swan Zone at Fosterville (current proven and probable reserve 3 Mt at 21.8 g/t gold for 2.1 Moz). There are two distinct sub-types of orogenic gold mineralization in Victoria (mesozonal and epizonal), formed during different metallogenic/orogenic events: the first recorded from the ~445 Ma Benambran Orogeny, and the second from the ~370-380 Ma Tabberabberan Orogeny occurring within distinct regional geological domains. The majority of gold recovered from the Victorian goldfields has been produced from the older, Benambran-aged mesozonal gold-quartz vein systems, targeted by the old-timers in the Bendigo and Stawell zones. More recently, Fosterville has rewritten the Victorian geological opportunity for epizonal gold deposits. We now understand that epizonal systems can develop extremely high-grade, free gold deposits, as the miners in 1859 demonstrated at Redcastle.

Redcastle Option and Joint Venture

Mawson has the option to earn an up to 70% joint venture interest in the Redcastle project from Nagambie Resources Ltd (ASX:NAG) (“Nagambie”) by incurring the following exploration expenditures: A$100,000 in the first year and an additional A$150,000 in year 2 to earn 25%, an additional A$250,000 in year 3 to earn 50% and an additional A$500,000 by year 5 to earn 70%. Once Mawson earns 70% a joint venture between the parties will be formed. Nagambie may then contribute its 30% share of further exploration expenditures or, if it chooses to not contribute, dilute its interest. Should Nagambie’s interest be reduced to less than 5.0%, it will be deemed to have forfeited its interest in the joint venture to Mawson in exchange for a 1.5% net smelter return royalty (“NSR”) on gold revenue. Should Nagambie be granted the NSR, Mawson will have the right to acquire the NSR for A$4,000,000. Mawson is also a major shareholder of Nagambie and owns 10% of the company.

Technical and Environmental Background

Michael Hudson, Chairman and CEO for the Company, is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release.

None of the drill data have been independently verified at this time. These historical data have not been verified by Mawson and are quoted for information purposes only. Assay techniques for gold and antimony are unknown at this stage.

About Mawson Resources Limited (TSX:MAW, FRANKFURT:MXR, PINKSHEETS:MWSNF)

Mawson Resources Limited is an exploration and development company. Mawson has distinguished itself as a leading exploration company with a focus on the flagship Rajapalot gold-cobalt project in Finland and its Victorian gold properties in Australia.

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of the novel coronavirus known as COVID-19 on the Company’s business, planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()