Highlights

- Total Recordable Injury Frequency Rate (“TRIFR”) of 2.7 per million hours worked compared to 3.0 per million hours worked at the end of the first quarter of 2020.

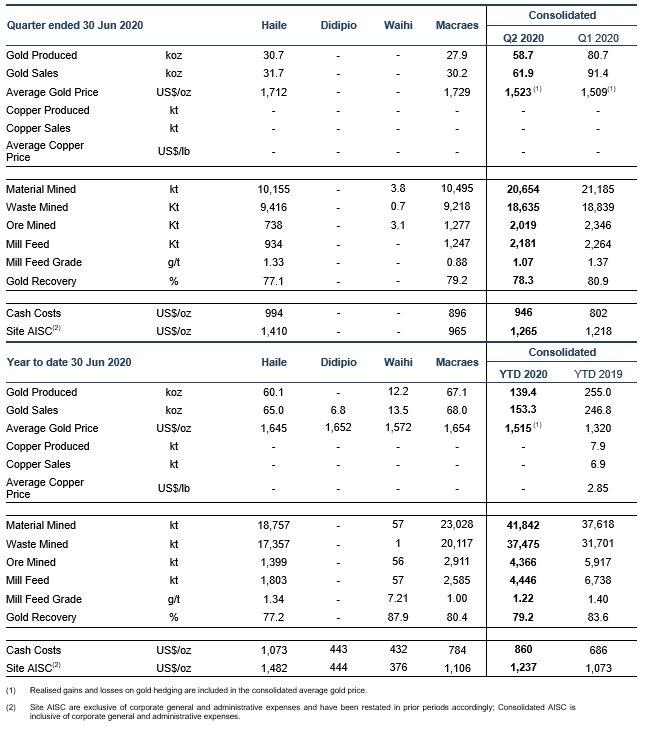

- First half of 2020 consolidated production of 139,385 ounces of gold at All-In Sustaining Costs (“AISC”) of $1,237 per ounce on sales of 153,343 ounces of gold.

- Consolidated second quarter gold production of 58,678 ounces at AISC of $1,265 per ounce on sales of 61,955 ounces of gold.

- First half revenue of $234.0 million with Earnings before Interest, Depreciation and Amortisation (“EBITDA”) of $54.8 million.

- Second quarter revenue of $95.8 million with EBITDA of $12.4 million.

- Cash balance and total immediately available liquidity of $147.7 million; net debt of $169.6 million.

- Subsequent to quarter-end, the Company delivered the Waihi District Study Preliminary Economic Assessment (“PEA”) with after-tax IRR of 51%, net present value (“NPV”) of $665 million and 2.2 million gold ounces produced over 16 years.[1]

- Advanced Martha Underground development with 1,342 metres completed in the second quarter and 2,855 metres year-to-date (“YTD”).

- Revised 2020 production guidance from 360,000 to 380,000 to 340,000 to 360,000 ounces. On a gold sold basis AISC is reduced from $1,075 to $1,125 to $1,050 to $1,100 per ounce sold.

- Guidance reduction due to lower Macraes production primarily related to the impact of the 5-week New Zealand COVID-19 restrictions which were lifted on April 27.

Michael Holmes, President and CEO of OceanaGold said, “We look forward to the second half where we continue to expect a material increase in production at both Haile and Macraes at lower AISC plus continued advancement of our key organic growth projects including those recently outlined in the Waihi District Study.

The second quarter was expected to be our weakest in terms of production, but the results also demonstrate the impact the global COVID-19 pandemic has had on our business. We have worked hard to safeguard the health and safety of our employees through the implementation of rigorous protocols including health screening, physical distancing and disinfecting throughout our operations. These protocols include the mandatory self-isolation of those exhibiting COVID-like symptoms, plus anyone with exposure to those exhibiting symptoms. This resulted in approximately 170 workers at Haile having to self-isolate at some point since the beginning of March. Despite this, Haile continues to increase mining rates at reduced unit costs.”

“In New Zealand, the Government mandated lock-down extended to five weeks during which time operations at Macraes included only limited processing with all mining suspended. This resulted in weaker than expected production for the quarter. Although the operation has recovered well, delivering near record mining rates in the month of May, the resulting shortfall in mining progress will impact the planned access to higher grades later in the year. As a result of this timing change, combined with the impact of the second quarter restrictions, the full-year guidance for the operation will be impacted and we are now expecting Macraes to produce between 140,000 and 150,000 ounces of gold at correspondingly higher cash cost and AISC.”

“Progressing our organic growth projects is a key deliverable this year. We completed 2,855 metres of development at Martha Underground in the first half, and first gold production remains on-track for the second quarter of 2021. We were pleased to release the strong results from the Preliminary Economic Assessment of the Waihi District subsequent to quarter end. The study highlighted the district’s potential, including production of 2.2 million gold ounces over 16 years of additional mine life at sub-$650 AISC per ounce sold. At Macraes, we expect to release results of the Golden Point Underground in the second half of the year.”

“Given the year-to-date impact at Macraes we are revising our consolidated full year 2020 production guidance to 340,000 and 360,000 ounces of gold (excluding Didipio). Lower operating costs and sustaining capital are expected to offset the production revision with consolidated AISC revised downward slightly to $1,050 to $1,100 per ounce sold. Consolidated cash costs remain unchanged at $675 to $725 per ounce sold. Haile’s gold production remains unchanged and we continue to expect increased production at lower AISC in the second half from both Haile and Macraes with the fourth quarter expected to be the strongest quarter of the year.”

Operations

In the first half of the year, the Company produced 139,385 ounces of gold, including 58,678 ounces of gold in the second quarter. Gold production in the first half of 2020 was 45% lower than the same period in 2019 primarily due to the temporary suspension of operations at Didipio. Quarter-on-quarter gold production decreased 27% with the completion of mining at the Correnso orebody at Waihi in the first quarter and lower than planned production at Macraes due mainly to COVID-19 restrictions in place during the second quarter.

Increasing consolidated AISC of $1,237 per ounce sold YTD and $1,265 per ounce sold in the second quarter reflected the lower sales. Cash costs for the first half of the year were $860 per ounce while second quarter cash costs were $946 per ounce, higher than the previous quarter and prior year due to mine sequencing and corresponding lower grades, partially offset by lower total operating costs.

During the second quarter, restrictions related to the COVID-19 pandemic impacted operations in New Zealand and Haile. In New Zealand, the government imposed a mandatory five-week shutdown at the end of March that restricted non-essential business operations, including gold mining. As a result, development of the Martha Underground at Waihi was temporarily suspended then resumed after lifting of the restrictions on April 27. 2,855 metres of underground development have been completed year to date, including 1,342 metres in the second quarter despite the development hiatus. Martha Underground remains on-track for first production in the second quarter of 2021.

At Macraes, mining was suspended and processing was restricted to remaining broken stocks and low-grade stockpiles during the five week COVID-19 lockdown. This, combined with an inability to effectively assay feed stocks during the suspension, resulted in lower than expected recoveries and production in the second quarter. Despite mining a record 5.2 million tonnes in May and 4.5 million tonnes in June, the five-week cessation in mining has adversely impacted our full year outlook at Macraes by delaying access to higher-grade ore from Coronation North in the fourth quarter. This material is now expected to be mined in the first half of 2021 and as a result some production will be deferred. The full year production for Macraes is now expected to be 140,000 to 150,000 gold ounces at an AISC of $1,100 to $1,150 per ounce sold.

At Haile, additional health and safety protocols were put into place, including health screenings for workers entering and exiting site, staggered shifts, social distancing, and where applicable mandatory self-isolation for members of the workforce. Though these additional measures impacted mine productivity and equipment utilisation rates, the Haile operation doubled mining movements and increased mill feed year-over-year while decreasing unit costs. Production from Haile increased slightly quarter-on-quarter, benefitting from higher mill throughputs despite record average monthly rainfall in May that, along with COVID-19 productivity impacts, limited access to higher grade ore zones in the open pits. The operation will deploy a further four Komatsu 730E haul trucks in the third quarter. The Company continues to expect Haile production of 180,000 to 190,000 gold ounces at lower site AISC of $1,020 and $1,070 per ounce sold with cash costs unchanged.

The Didipio mine remained suspended during the quarter due to ongoing restraints placed on the operations by local government units and anti-mining blockade of the access road. The Company has maintained Didipio in a state of operational readiness for rapid re-start on the expectation that a resumption of normal operations could be achieved in 2020, either through lifting of restrictions imposed on access, or completion of a renewal of the Financial or Technical Assistance Agreement (FTAA). In the second quarter, a working team created by the President completed a review of the FTAA renewal which included engagement with the Company before re-endorsing the renewal to the Office of the President where it remains for a decision. The Company is unable to provide timing on when a decision will be made, however by mid-October the Company is required to decide on the on-going status of the Didipio workforce as temporary lay-offs commenced in mid-April.

Financial

In the first half of the year, the Company generated $234.0 million in revenue, a decrease from the prior year period mainly due to limited sales from Didipio and reduced sales from Waihi. Quarter-on-quarter revenue decreased 31% with no sales recorded at Didipio, the completion of mining at the Correnso orebody at Waihi, and lower sales from Macraes where production was impacted by the New Zealand Government’s COVID-19 lock-down.

First half EBITDA of $54.8 million decreased 59% year on year, primarily reflecting limited sales from Didipio and lower production from New Zealand partly offset by steady production from Haile at improved cash costs. The quarter-on-quarter decrease in EBITDA reflects reduced revenue from lower sales in New Zealand.

Net loss before unrealised losses on undesignated hedges was $31.5 million or $(0.05) per share on a fully diluted basis in the second quarter and $42.3 million or $(0.07) per share on a fully diluted basis YTD. The quarter-on-quarter and year-over-year decrease was mainly a function of the lower revenue from reduced sales volumes. Total net loss was also impacted by an income tax expense of $4.1 million compared to a tax benefit of $5.7 million in the previous quarter. The second quarter tax expense was higher despite a larger overall net loss primarily due to the operational profits in New Zealand and unrealised foreign exchange gains on non-New Zealand currency denominated loans. Additionally, there were no potential tax benefits recognised associated with the costs incurred to maintain Didipio in a state of operational readiness.

Operating cash flows YTD were $137.3 million, an increase year-over-year, mainly attributable to $78.5 million received from the gold presale in the first quarter, partly offset by lower operating cash flow from Waihi and Didipio. YTD fully diluted cash flow per share before working capital was $0.09, excluding the impact of the gold presales, and $0.02 for the second quarter.

First half investing cash flows of $84.7 million were 37% lower than the prior year period, primarily due to lower capital expenditure at Didipio, reduced capitalised pre-stripping activities at Haile and Macraes, lower exploration, and proceeds from the sale of a non-core equity interest.

As at June 30, 2020, the Company’s cash balance stood at $147.7 million, and net debt increased quarter-on-quarter to $169.6 million, reflecting the decrease in cash and increase in equipment finance associated with the progressive upgrade of the mining fleet at Haile and the refinance of recently acquired mining equipment in New Zealand. The Company has fully drawn down its $200.0 million revolving credit facility, which currently matures on December 31, 2021.

Growth

The Company continues to advance its organic growth pipeline including the Waihi District opportunities. On July 16, the Company announced the results of the Waihi District Study Preliminary Economic Assessment which demonstrated positive results with an after-tax IRR of 51% and NPV of $665 million over a 16-year mine life. Readers are cautioned that the PEA is preliminary in nature. It includes Inferred Resources that are considered too geologically speculative to have economic considerations applied to them in order to be categorized as Mineral Reserves, and there’s no certainty that the PEA will be realised. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

The results were based on four distinct opportunities that included the Martha Underground, WKP, Martha Open Pit and Gladstone, each with different points of entry, capital requirements, production levels, cost structures and mine life.

The Martha Underground is fully permitted and in development with first production expected in the second quarter of 2021. The other opportunities are not permitted and will have permit applications lodged in 2020. The Company continues to drill mainly at Martha Underground and WKP with a focus on resource conversion and expansion.

The Macraes Golden Point Underground study continues to advance with expected completion in the second half of the year. While at Haile, the Company is further optimising the Horseshoe Underground mine sequence and expects to complete this work by the end of the year.

Conference Call

The Company will host a conference call / webcast to discuss the results at 7:30 am on Friday July 31, 2020 (Melbourne, Australian Eastern Standard Time) / 5:30 pm on Thursday July 30, 2020 (Toronto, Eastern Daylight Time).

Webcast Participants

To register, please copy and paste the link below into your browser:

https://produceredition.webcasts.com/starthere.jsp?ei=1341360&tp_key=2f24cc1848

Teleconference Participants (required for those who wish to ask questions)

Local (toll free) dial in numbers are:

North America: 1 888 390 0546

Australia: 1 800 076 068

United Kingdom: 0 800 652 2435

Switzerland: 0 800 312 635

All other countries (toll): + 1 416 764 8688

Playback of Webcast

If you are unable to attend the call, a recording will be available for viewing on the Company’s website.

[1] The PEA is a preliminary technical and economic study of the potential viability for the Waihi District project. The production target and financial forecast referred to in the PEA are comprised of 51% Indicated Mineral Resources and 49% Inferred Mineral Resources. Inferred Mineral Resources are considered too geologically speculative to have economic considerations applied to them in order to be categorized as Mineral Reserves. There is no certainty that further drilling will convert Inferred Resources to Indicated Mineral Resources or that the PEA will be realised. Further drilling, evaluation and studies are required to provide any assurance of an economic development case. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

About OceanaGold

OceanaGold Corporation is a mid-tier, high-margin, multinational gold producer with assets located in the Philippines, New Zealand and the United States. The Company’s assets encompass the Didipio Gold-Copper Mine located on the island of Luzon in the Philippines. On the North Island of New Zealand, the Company operates the high-grade Waihi Gold Mine while on the South Island of New Zealand, the Company operates the largest gold mine in the country at the Macraes Goldfield which is made up of a series of open pit mines and the Frasers underground mine. In the United States, the Company operates the Haile Gold Mine, a top-tier, long-life, high-margin asset located in South Carolina. OceanaGold also has a significant pipeline of organic growth and exploration opportunities in the Americas and Asia-Pacific regions.

OceanaGold has operated sustainably since 1990 with a proven track-record for environmental management and community and social engagement. The Company has a strong social license to operate and works collaboratively with its valued stakeholders to identify and invest in social programs that are designed to build capacity and not dependency.

For 2020, and subject to the cautionary statement below, the Company expects to produce between 340,000 and 360,000 ounces of gold from Haile, Waihi and Macraes combined at a consolidated All-In Sustaining Costs ranging from $1,050 to $1,100 per ounce sold.

Technical Disclosure

Mine Designs, schedules and economic analysis for Waihi District Study have been verified and approved by, or are based upon information prepared by or under the supervision of, T. Maton. T. Maton is a Member and Chartered professional with the Australasian Institute of Mining and Metallurgy. Mr Maton have sufficient experience, which is relevant to the style of mineralisation and type of deposits under consideration, and to the activities which they are undertaking, to qualify as Competent Persons as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” (“JORC Code”) and all are Qualified Persons for the purposes of the NI 43-101. Mr Maton is an employee of OceanaGold and they consent to the inclusion in this release of the matters based on their information in the form and context in which it appears. For further scientific and technical information (including disclosure regarding Mineral Resources and Mineral Reserves) relating to the Waihi PEA and Operation, please refer to the PEA which will be filed on SEDAR on or before 30 August 2020, and NI 43-101 compliant technical reports available at sedar.com under the Company’s name.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, achievement of guidance, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the outbreak of an infectious disease, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company’s control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()