"I think the green movement has become much more powerful and important globally than it used to be," said Simon Popple of the Brookville Capital Intelligence Report in a recent interview on INN. "The more governments embrace nuclear, green energy (and) electric vehicles, I think the more demand there will be for uranium," he said in the interview. "The demand for electricity is going to be very high, and that electricity has to come from somewhere." In fact, the new cycle for nuclear power, and therefore uranium demand, has already begun. This can be read in the price of the energy source. Uranium on the spot market now costs more than 48 US dollars per pound (454 grams) again. Companies with fundamentally good uranium projects can already live with this. Older and largely dismantled projects, on the other hand, are having problems and will not yet stimulate supply again at these prices.

One example of how nuclear power has been viewed recently is Poland. The government in Warsaw has received an offer from the French utility and nuclear power plant operator EDF to build four to six nuclear power plant units there. EDF wants to take over the engineering, procurement and construction of the EPR (European Pressurized Reactor) with a capacity of up to almost ten gigawatts. For Poland, the incentive here is not only that there could be greater security of electricity supply in the long term. In addition, up to 25,000 jobs would be created, at least temporarily, per reactor unit during the construction phase and operation.

Nuclear power plants are currently being built all over the world and even more are being planned. But these require fuel, namely uranium. Demand for uranium is therefore likely to increase significantly in the long term, even if nuclear power plants per se become increasingly efficient. The price of the energy source should therefore tend to rise further. These are in turn very good conditions for mining companies that have good uranium projects. Uranium Energy and Consolidated Uranium, for example, belong to this group.

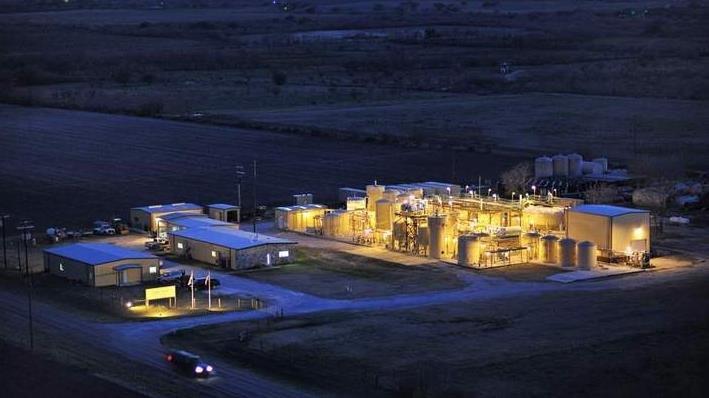

Uranium Energy – https://www.youtube.com/watch?v=oMaVTwhuAuQ – has environmentally friendly and low-cost uranium projects in South Texas and Wyoming, some of which have already been approved.

Consolidated Uranium – https://www.youtube.com/watch?v=_GzHL8pnm58 – has moved to acquire uranium projects around the world, most recently again in Quebec, to be ready for uranium demand.

Current corporate information and press releases from Uranium Energy (- https://www.resource-capital.ch/en/companies/uranium-energy-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()