The updated MRE is reported using a 0.05% tin (“Sn”) cut-off to a maximum depth of 300m below surface (650mRL):

This is a substantial 240% increase in size on the previous MRE announced by Aus Tin Mining Ltd in 2014 which was calculated using a 0.10% Sn cut-off. The lower cut-off for the updated Mineral Resource is based on revised economic considerations including higher 3-year trailing tin prices, lower AUD:USD exchange rates and preliminary estimates of mining, processing and G&A costs.

A direct comparison with the 2014 MRE using a 0.10% Sn cut-off is:

The comparison represents a 40% increase in total contained tin metal based on the same cut-off. The difference is primarily due to:

- Exploration drilling by First Tin successfully extending the Mineral Resource to the southwest of the existing estimate

- A new geological interpretation

- A reconfigured grade interpolation technique

A Measured Resource category has been included for the first time. This is based on the successful hole twinning drill programme conducted by First Tin which validated the Newmont drilling data alongside a more in-depth study of the Newmont QAQC data which confirmed the reliability of the historic drilling data.

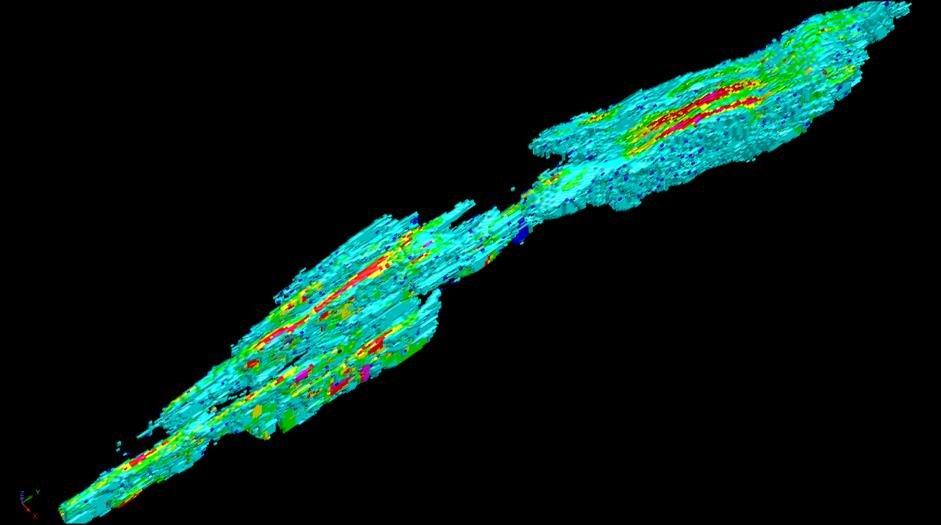

A grade-tonnage table is included as Table 1 with a graphical representation shown as Figure 1.

First Tin CEO Thomas Buenger said: “The 2023 MRE represents the culmination of a highly successful drill campaign at Taronga, which opened up new areas of mineralisation and validated previous data. We are very pleased with the large increase in contained tin and the addition of a Measured Resource category, which provides further confidence in the MRE. The grade-tonnage curve shows that the Mineral Resource Estimate is robust and that significant tonnages of higher-grade material exist that will in turn reduce risk due to changing tin prices.”

The project is owned by First Tin’s 100% owned Australian subsidiary, Taronga Mines Pty Ltd (“TMPL”).

Enquiries:

First Tin Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Molly Gretton FirstTin@secnewgate.co.uk

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()